Manic Stocks Alerts Watchlist 10/15/12

1st things 1st. Look at the Dow and S and P charts and u can see whats coming.

Play safe and take correction time to make a shopping list of the charts u want to buy at a Big Discount to where they are now. Or pick select short positions.

Last Week was tough for longs when the market pulled back most of the week. S&P should bounce this week off her 50 day on the daily chart.

PLEASE Read Disclaimer at end of this Newsletter thank you.

$COGO - Comtech Group 2.29,

Original alert at 1.83. Very strong daily and weekly charts. She popped to 2.39 from 1.75 and since has been pulling back. I say she retraces back to her 200day at 2.10ish, the 50day sma on the weekly chart before she continues imo. Looking for a continuation. Nice potential upside from here.

$KWK - Quicksilver Resources 4.85,

Strong close friday above her 200day makes me think were going higher. 3.35 1st alert back in late august. We have been swinging her the whole way. After a consolidation phase shes looking good again. If she can stay above i say, she goes to the weekly 50day next resistance imo or she goes higher to previous resistance.

Option Players, Oct 5 calls seeing love, no volume in nov yet.

$FCEL - FuelCell Energy .95

An old stock we used to trade looks like it could be setting up to finally reverse to the upside. She has a support of .80 from oct 2011 she has to hold and a soft support at .85 now. Daily and weekly charts looking strong so keep an eye on this one.

VIMC has been in a tight Trading Range since May .71 to 1.10 area, looking for a upper trend line Break out here as the volume and indicators have stepped it up a notch here last week

LPH showing a weekly W pattern Neckline potential brelout with 2nd pull back point being a higher low than the previous low last October

$CLNT - Cleantech Solutions

$CLNT if u have been following me you've been seeing me post alot on that ticker. I nailed it from 2.06. Swinging her along the way of course. Chart below shows a real nice trend we had and just goes to show u that when a chart looks ready to explode, it doesnt lmao.

Anyhow We watched her dip day before yesterday,all the way to previous support. Looked around for bad news but only came up with good news lol.

Cleantech Solutions Receives $2.2 million Purchase Orders for Airflow Dyeing Machines (Wed, Oct 10)

http://finance.yahoo.com/news/cleantech-solutions-receives-2-2-120000061.html

If she can get over her love affair with the daily 200day sma and climb above the 50day on the weekly, there really isnt much for a while. Granted news stays positive.

I am just playing this for fun and technicals. I say she will blow to the upside eventually, just have to be patient imo.

Mid Week i Alerted $ASTI off the her 200day, she holds this i still love it.

$AEZS did a stock offering after my alert wich tanked the stock lol, damn bios always needing money. Now shes almost at a double bottom, watch her for bounce reversal from here. She has to hold 2.27 support.

$GNW had a little pop from alert 5.39-5.64, she has to hold her 50 & 100day sma here.

$VVUS had a great week. Oct 9th Pulling back pre market to 19.68 to close at high friday of 23.41. Congrats to those that made bank with us on that trade.

$LXRX i still like for a continuation

I also Like $CDTI low floater for a continuation very soon.

Big Board, Option Plays.

(We Are Not Option Experts, just love the money to be made with them and leverage. Allows those of us without a million dollars to trade Stocks we normally couldn't afford to buy alot of shares in.)

Charts Looking Interesting

$HAS - Hasbro Inc.

Earnings oct 22, could be a nice winner into christmas?

Love this Breakout chart. Daily chart showing a pop above the bollie, so we can probably expect a pullback before the next move up but check pre market for sentiment. Weekly chart, closing above her 100day (very Bullish) clear skies ahead.

40 strikes showing nice volume and open interest.

$JCP - Jc Penny Co.

Earnings Nov 9

Interesting charts and one to watch going forward. Macd cross on the daily with indicators reversing bullish, daily, weekly and monthly charts showing the 13day getting ready to cross above the 20 day sma (This is usually confirmation of new uptrend, a cross below is bearish) She may pull back and test the 20/50 day at 25.50ish area. Would say the 20 day sma is support on the weekly chart.

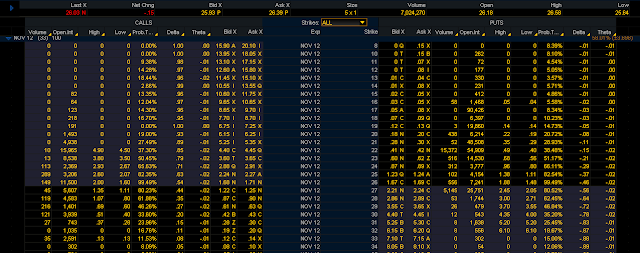

25 and 26 Strike showing activity, but look at Nov put option chain

$EA - Electronic Arts

Earnings Oct 25

Charts showing possible reversal here. Options are mixed, ask to puts, so trade accordingly.

Watch your Ma and Fib lines for support and resistance. Beautiful Macd cross on the daily with other indicators moving into the power zone. 13 day sma getting ready to cross above the 20 on both the daily and weekly charts. One to watch with that sector taking a beating and due for some love.

(NOTE: There is no guarantee that any of these will move X% after we alert them, but what we give you is the chart and tools to make the most of these type of trades. We ride them from support to a sell target then wait for the pull back and ride them again. Stick with what works or the same stocks, become familiar with their trading patterns.)

Do your research and check fundamentals, earnings etc. Also don't forget to follow the Dow and S&P, VERY IMPORTANT!!

Time your entries with the general market and sentiment.

If the General market is correcting then its a great time to make a list of your favorite stocks and look to get them at great prices. These small cap stocks listed usually will follow general market direction up or down, so pay attention.

Also always look at your weekly and monthly charts, not just the daily. Pull the charts back and see the whole story.

I still continue to like and follow these previous stocks that are working. Until the charts are broken, there is no reason to stray. I play them to a target then either short or wait till it pulls back and gets ready for its next move up.

Small caps stocks sometimes are just slow and steady gains and on occasion we get a Ripper and we do well just playing the swings. Penny Stock traders get used to quick gains and can lose interest quick.

Myself i get impatient sometimes and sell, only days after the stock does that i thought it would do lol. PATIENCE IS GOLDEN with Trading! Especially if you have no day trade status (Over 25k)or a margin account and have only 3 round trips a week.

Please time your entries and exits according to your moving average lines and fibinocci retracements. We are here to answer questions on everything from trading, charting, shorting and options. We have been thinking of offering Free classes

Either on Skype or in conjuction with investors Hub.

Sometimes we are early when we post a chart we like, but being patient pays off when they bust open. We pick a nice entry and put in a stop a little under support and if she breaks support we get stopped out, take a little loss and move on or try next support.

Lots of these have huge upside. These are all bullish set ups or ones that catch our eye and follow until support is broken or they breakout.

Trading & Charting Questions? Ask Manic

@ manictrader@stockgoodies.com

Disclaimer

We are not financial advisors and not qualified to give advice. Anything we post or charts we annotate are only our opinion and NOT a recommendation to buy. We may or may not have positions in securitys listed.

No comments:

Post a Comment